Monetary inflation refers to inflating the supply of money, or increasing the number of currency units in circulation.

This happens when the government ‘prints money out of thin air’, or when money is loaned into existence by a bank.

Minting new currency units decreases the value of existing currency units.

Inflation is when new currency units are produced by an authorized entity.

Counterfeiting is when currency units are produced by a non-authorized entity.

The key difference between inflation and counterfeiting depends on who is creating the money. If you create money it’s a felony. If the government creates money, it’s ‘fine’.

No matter who creates new money, the effect on the economy is the same.

If you believe that creating counterfeit money is morally wrong, then you should fundamentally oppose inflation and the fiat currencies which enable it.

Inflating The Money Supply

Inflation (the economic concept) comes from the same word as inflating a tire, or inflating a balloon.

Printing money inflates the money supply, making the total stock of money larger.

However, this doesn’t change the amount of goods and services in an economy.

Why Is There Inflation?

There is inflation because the current global monetary system is based on un-backed fiat currencies (like the US Dollar) that are always losing value.

Inflation persists because governments run a budget deficit, and print money to cover the difference.

Why does the government print money?

Because they can.

If you had a credit card that never had to be paid off, would you use it? Maybe you have too much integrity to lavishly spend money that isn’t yours.

But what if you used the credit card to buy a meal for a homeless person? Or to reimburse a victim of theft, or provide medical care for someone who couldn’t afford it?

A government that controls their currency is like the person with the credit card in this example.

Inevitably, government spending increases over time as they try to intervene in more places throughout the economy.

Big Government Spending

Most government spending programs fund what seem to be good ideas, however, there’s a few problems.

The first major problem is that inflation is theft, and if government spending is funded with inflation – this is a moral dilemma at best.

The second problem is that trusting a centralized authority to decide what is best for everyone doesn’t typically end well.

The third problem is that almost anything a publicly funded entity can do, a private one can do more efficiently.

The fourth problem is that government spending is not an altruistic redistribution of wealth from the rich to the poor – it’s actually the opposite.

Money Flows To The Top

The biggest losers in this system are the poor, and middle class. In the end, the money flows back to the top, and accumulates in the pockets of the rich.

The United States operates in a semi free-market economic system that I consider to be crony capitalism. The proceeds of the money printer are absorbed by those in power, the elites, and the friends & associates of the state.

They want you to think that deficit spending on social programs are a net-benefit for the recipients.

They don’t want to you think about the how, or the why behind inflation.

They don’t want you to realize that a little bit of socialism is only the beginning.

They would like you to believe that inflation is just a normal fact of life.

They want you to accept that the cost of goods and services increases slowly over time.

But this is just not true.

Prices Decrease Over Time??

Goods and services DO NOT become more expensive over time. Yup, you read that right.

The cost of goods DECREASES over time.

Goods and services become less costly to produce due to a concept called technological innovation.

Increases in technology bring about new and innovative manufacturing techniques that drive down costs.

Economies of scale also bring down the cost of production by mass producing goods, which is more efficient.

Advances in technology have brought about larger, more efficient cargo ships, planes, trains, and semi trucks.

This ushered in an era of globalization and free-trade which allowed countries to specialize and exchange goods with trading partners. This also drives down prices.

If goods and services have become so much less costly to produce in the past 100 years, then why do prices continually rise?

The value of a dollar is decreasing more rapidly than goods are decreasing in cost.

This is why the nominal cost of goods (in dollar terms) increases over time. Dollars are losing value more quickly than goods can decreasing in cost.

Pricing goods in dollars makes long term economic planning nearly impossible because the value of a dollar is constantly shrinking.

Imagine trying to build a house with a tape measure that slowly shrunk over time.

What Is The CPI?

The consumer price index (CPI) is calculated by the Bureau of Labor Statistics (BLS). It approximates the cost of living by tracking a basket of consumer goods, housing costs, and energy prices.

“CPI” is used synonymously with inflation. Most people have no idea that that CPI inflation data is neither accurate, nor representative of actual inflation.

I disagree that CPI = Inflation for a number of reasons, but most simply because:

CPI Is A Lie

The Bureau of Labor Statistics continually changes how they calculate the CPI. They also change the actual items inside the ‘basket of consumer goods’ that are being being tracked. They call this: hedonic quality adjustment.

The BLS is subject to political pressures, they change the way they calculate the index, and they substitute the actual items that they are being tracking for cheaper ones.

The accuracy of the CPI is very questionable.

The US Dollar Is A Poor Measuring Stick

The value of one US dollar is continually decreasing. Every single year more, and more, and more US dollars are created.

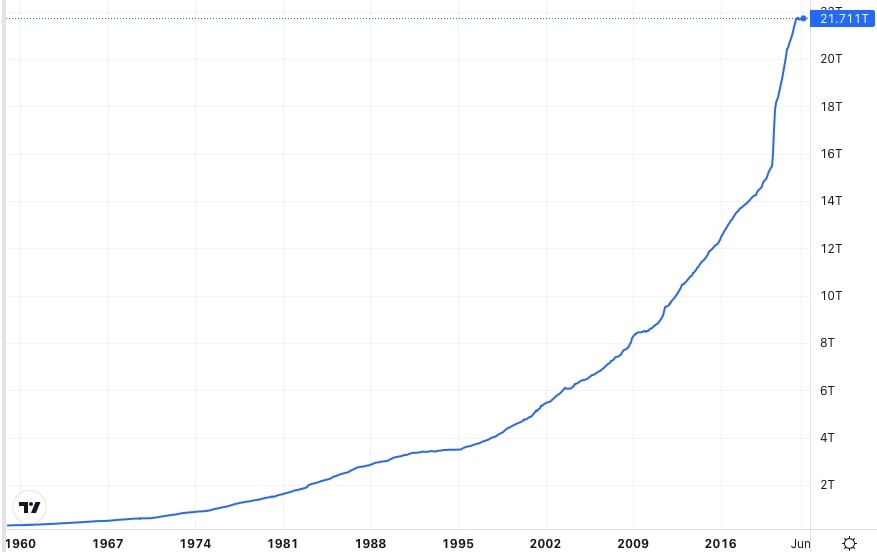

Below is a chart of the US M2 Money supply from 1960 – 2022. Although M2 is not a perfect metric, it demonstrates how money is being created over time.

The growth of M2 money supply has been non-linear. It has been increasing exponentially. This seems highly unsustainable.

How Can You Beat Inflation?

Considering this website is called Bitcoin Makes Cents… you can probably guess the answer here.

Bitcoin!

When you own bitcoin, you own a share of the value of the Bitcoin Network, and this cannot be diluted.

There will only ever be 21 million bitcoin, and the unlike fiat currencies, the supply cannot be inflated.

At some point in the future, I believe that the era of mild inflation in the United State will end, and it will be succeeded by an era of high inflation.

When a currency loses value rapidly, people exchange their weak money for stronger money.

This can create a doom loop of currency devaluation, followed by capital flight, which leads to further devaluation.

People will try to store their value in anything besides a rapidly devaluing currency.

If bitcoin becomes the #1 preferred destination for capital flight, it will appreciate in value extraordinarily quickly, and not just in dollar terms, but in real purchasing power.

For this reason, I believe that everyone should have a non-zero bitcoin allocation in their portfolio.

The 1% Portfolio Allocation

Here’s why I recommend a 1% bitcoin portfolio allocation:

In a financial crisis where the United States Dollar is hyper-inflating and bitcoin is on the receiving end of mass capital flight… a 1% bitcoin allocation will likely become more valuable than the other 99% of your dollar denominated assets.

You don’t have to spend thousands of dollars on a whole bitcoin – you can get started with as little as a dollar.

I recommend starting out with a very small purchase to familiarize yourself, and learn more about how bitcoin works.

To learn more about bitcoin, get started here: Why You Shouldn’t Ignore Bitcoin

Ready to get started? Check out Strike – it’s my favorite place to buy bitcoin.