In this article, we’ll discuss the strategy of holding bitcoin forever and never selling. Why you might want to do it, and how it benefits you.

If you’ve decided to hold a non-zero allocation of bitcoin in your portfolio, the next investment decisions you’ll need to tackle are: how to buy, over what time period, and how long to hold.

In this article, we’ll stick to talking about how long to hold.

Warren Buffet once famously said:

“Our Favorite Holding Period Is Forever.”

Although Warren is not a fan of bitcoin, he is an absolutely legendary investor, and his holding strategy can be perfectly adapted to bitcoin.

How Long Should You Hold Bitcoin?

So, let’s talk about why it makes cents to hold bitcoin forever. To keep things extremely simple: the price of bitcoin has continually gone up over time – so you want to hold it as long as you possibly can to maximize gains. Forever is ideal.

Short Term vs. Long Term

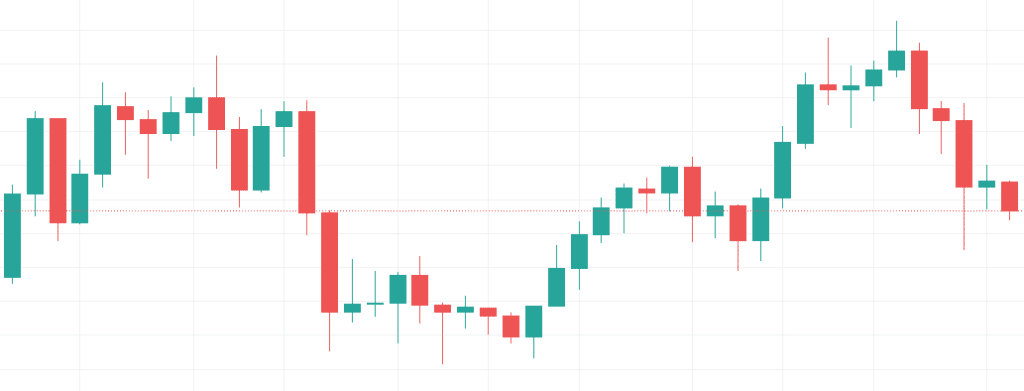

Over the course of days, weeks, and months, the price of bitcoin goes up, down and sideways. The price chart below shows the price of bitcoin going up and down for about 10 months (weekly candles: Feb 2021 – Dec 2021).

Bitcoin purchased in Mid February, 2021 drifted in and out of profitably over the course of the year. This is very typical for shorter timeframes.

However, when you zoom out and look at price appreciation over the course of several years – bitcoin only goes up!

In the chart below (log scale), the price of bitcoin goes from sub $10 to over $40,000 during the course of 9 years – a gain of roughly 100,000%.

Despite massive gains over this 9 year period, there was a few times when you could have lost money by buying at a peak, and only holding for a year.

It’s important to lower your time preference, and hold bitcoin over the long term. The longer you hold, the greater the odds of your investment being profitable. And of course you don’t want to just break even, you want to be HIGHLY profitable.

Throughout the entire history of bitcoin, if you held for 4 years or more, your odds of profitability were 100%. The lowest 4 year return in bitcoin history is about 140%.

Any signifiant investment in bitcoin that was held for 5+ years created incomprehensible gains, and life changing wealth.

Why Does Bitcoin’s Price Go Up?

Past performance does not guarantee future performance. No one can see the future, and there’s no absolute guarantees that bitcoin’s upward path will continue. However, when you start looking at why the price of bitcoin appreciates overtime, it all starts to make sense.

Bitcoin’s value is derived from its utility, its use, and its adoption in the real world. Over time, more and more people have chosen to start using bitcoin as a savings technology, and a transactional medium.

The price side of the equation can be explained quite simply with supply and demand. Because bitcoin is a fixed-supply asset, increased adoption (demand) in the market necessitates higher prices to accommodate all market participants.

In short: more people holding and using bitcoin = higher price. As long as adoption continues to increase, so will price.

Trying To Time The Market

As with every volatile asset, price the price of bitcoin fluctuates over time. If you could forecast these trends, you would be able to outperform the market substantially.

The truth is that trying to outperform the market sounds great, but it’s impossible to predict these price fluctuations with a high degree of accuracy.

It’s quite literally 100% impossible to perfectly time the bottom and the top of every price cycle, even for the best traders in the world.

Because it’s impossible to perfectly time the market, successful traders usually either:

- Scale up their positions into weakness and scale out into strength.

- Attempt to time the market & be right more often than they are wrong.

For the average retail investor that is interested in using bitcoin as a savings technology, trading is simply not worth it.

Especially if you have a low time preference, buying and holding will outperform trading strategies.

“Time in the market beats timing the market.”

Ken Fisher

In addition, every trade you make will have a tax implication. This means that if you’re trading to outpace market gains, you also need to outpace the market + the tax burden.

Simply holding and accumulating unrealized gains has no tax implications – this is my preferred strategy.

Tax Implications

You don’t pay capital gains taxes until you sell an asset, and realize the gains (or losses). Because of this, if you hold forever, you’ll never pay taxes on your Bitcoin.

So what good does it do you if you NEVER sell – how does it benefit you?

The answer is actually quite simple: Bitcoin will become a great asset to borrow against, much like real estate. Borrowing against an asset has no tax implications, and it is the preferred tax strategy of the wealthy (because it’s legal tax evasion).

OK, so if you borrow against your bitcoin, how to do you pay back the loan? The answer may surprise you.

The most tax advantaged way to pay back the loan, is after you’re dead. Yes, really. Please do not take my advice – consult an accountant & estate planning lawyer.

In the US, it’s possible to execute a legal plan that allows for a beneficiary to step-up the cost basis of an asset when the benefactor passes. This creates a tax efficient way to sell off some bitcoin and pay off the loan.

How To Borrow Against Your Bitcoin

Some people simply hate debt, and don’t want the burden or the stress of debt in their life. I completely respect that, and although it technically is not the most tax advantaged plan, it is appealing in its own right.

I say this as a preface to the borrow against your bitcoin section, because I also want to promote long term holding, and selling as needed.

I believe bitcoin is an excellent savings technology, and there is nothing wrong with selling when your future self needs to utilize past stored energy and productivity.

Bitcoin is an immature asset with extremely high volatility. To learn more about bitcoin volatility, check out my article Why Is Bitcoin So Volatile?

Because of these market conditions, I don’t recommend borrowing against your bitcoin now, and probably not for the next 5+ years.

As long as bitcoin’s volatility remains high, I recommend against bitcoin loans because they are marked-to-market and collateralized with bitcoin.

A bitcoin collateralized loan is a loan where a lender holds your bitcoin as collateral, and they lend you money (usually US dollars, or stable coins like USDC, Tether, ect.).

This loan structure has essentially zero default risk for the lender because if the borrower quits making loan payments, or if the value of your bitcoin collateral falls too much, the lender will sell your bitcoin to pay off the loan (liquidation).

The combination of bitcoin’s extremely high volatility, and the liquidation risk of marked-to-market loans make borrowing against bitcoin very ill-advised.

As markets mature, their volatility goes down. So as bitcoin matures, potential gains will be smaller, but large price drawdowns will also become much smaller.

Once this stabilization has occurred, borrowing against your bitcoin will become an excellent strategy (as long as the step-up cost basis strategy remains viable).

Thanks for reading!

Keep stacking Sats and hold strong.