You’ve probably heard about bitcoin a few times over the years. It gets talked about in financial news, on social media, and maybe you have that one friend who mentions bitcoin every single time you see him.

If you’re anything like me, you probably dismissed bitcoin the first 500 times you heard about it. Why should I care about bitcoin anyway?

I’m here to try to answer that question.

What Is The Point of Bitcoin?

Dollars work just fine, right? So why does anyone need bitcoin?

If you’re a US dollar user, then rapid currency devaluation hasn’t been a problem in your lifetime. However, bitcoin was designed as an alternative for those who don’t have access to a stable currency.

The need for a non-state alternative money is not intuitive for people who grew up in developed countries like the United States, Japan, Australia, and countries in the European Union.

If you have access to the banking system, and use a currency with a relatively low inflation rate, then understanding the point of bitcoin isn’t immediately obvious.

Bitcoin is more easily understood in countries that have rapid inflation, lack banking infrastructure, or have high censorship.

If you:

- Have a bank account

- Your money holds its value between the time you’re paid, and the time that you spend it

- You are not denied access to your accounts

- You are allowed to spend your money at your discretion

Then it’s easy to overlook the deeper problems with inflationary fiat monetary systems (US dollar, Euro, Yen, Peso, etc).

Most people are used to inflation because it’s all they know. We’re trained to think that a little bit of inflation is fine, good actually.

But here’s a bold statement for you.

Inflation is theft. It doesn’t matter if a currency user is being robbed of 1% per year or 99% per year – theft is theft.

Inflation Is Theft

Throughout history, every time a currency is inflated /debased / printed, it leads to a drastic devaluation, or the currency becoming entirely worthless. In some cases this happens rapidly, other times it takes many decades.

The concept of inflation as theft is easier to understand if you think conceptually on a small scale.

Consider this example:

You’re playing the board game Monopoly with one other player. A Monopoly board game comes with roughly $20,000 in bank notes (aka monopoly money).

For this example, the $20,000 Monopoly money, is evenly distributed between you, and your opponent. Each player has $10,000.

Think of these bank notes not as money, but as claims for properties on the board. With your $10,000, you’re entitled to 50% of the value of the properties on the board.

Next, the other player gets out his printer, and prints up an additional $10,000.

Your opponent now has $20,000, and you still have the exact same $10,000. There is now $30,000 in claims on the value of the properties on the board.

Your $10,000 now represents a claim on 33% of the value of the properties on the board. By printing an addition to the money supply in the game, your opponent has stolen the value of your claim from 50% down to 33% without ever touching your money.

The real economy is drastically larger and more complex than a two person Monopoly game, but the concept remains the same.

Each additional currency unit that is created dilutes the value of all existing currency units.

When a government prints money, it is stealing from all users of the currency – this is why inflation is theft.

If “all users of the currency” are the victims of the theft, then let’s take a look at who the United States is stealing from when they print money.

The US Steals From The Entire World

The United States Dollar has the luxury of being the world reserve currency. It isn’t just Americans that use the dollar, it’s pretty much everyone.

Almost anyone in the world is willing to accept US dollars in exchange for goods and services.

The United States and its five U.S. territories all use the dollar. There are also 11 foreign nations that are dollarized, which means that the US dollar is their official currency.

There are numerous other countries, regions, and cities that unofficially use the dollar in some capacity.

Additionally, much of international trade is settled in US dollars (USD). USD is often used to settle trade, even when a country is not conducting trade with the US.

For example, if Germany wants to purchase petroleum from Saudi Arabia, they sell Euros to buy USD on the foreign exchange markets, and then make the payment in USD.

After the trade is settled, Germany has their petroleum, and Saudi Arabia is left with dollars. Most often, countries with trade surplus dollars with use those dollars to purchase United States treasury bonds (which end up as foreign exchange reserves).

Over the past 40 years, many countries have executed this foreign exchange trade playbook repeatedly, amassing huge amounts of treasury bonds. This strengthens the US dollar system, and finances the United State’s structural trade deficit.

Quick review:

- Inflation is theft.

- When a government prints money, it steals from all users of the currency.

- almost everyone in the world is a user of US dollars.

Therefore, when the U.S. prints money it steals from the entire world.

Global Dollar Demand

The United States dollar system has an extremely broad base of users, and that creates a tremendous amount of demand for USD – and United States treasury bonds.

This demand makes it possible for the US to print a ludicrous amount of currency units, and the amount of value it is stealing from each individual currency user isn’t all that apparent (aka inflation remains low).

Here’s the takeaway:

The United States prints money excessively with very little consequences to domestic users of the dollar. Essentially, they are able to get away with it (for now).

The United States can, and does abuse this privilege.

Other countries do not like being stolen from.

Other countries do not like using the dollar.

Other countries are interested in alternatives to the dollar.

So why does everyone keep using the dollar? In short, because everyone else still does, due to a lack of viable alternatives, and also because of geo-political pressures (fear of military aggression).

The current global monetary system was setup in post-WWII era. The system was created to favor the United States because they won the war, and they had the most say in how the system was constructed.

The US Dollar Will Die Eventually

The US dollar could lose its position as the global reserve currency within the next decade or two. But, there is a 99.9999% chance this WILL happen at some point in the future.

This is my personal opinion: a currency war of some sort will ensue, and the monetary system as we know it will be ended, or altered. I don’t know how all this will play out, no one does. But monetary systems will change.

If these changes result in drastically less global demand for the US dollar, the United States will no longer be able to print money without consequence.

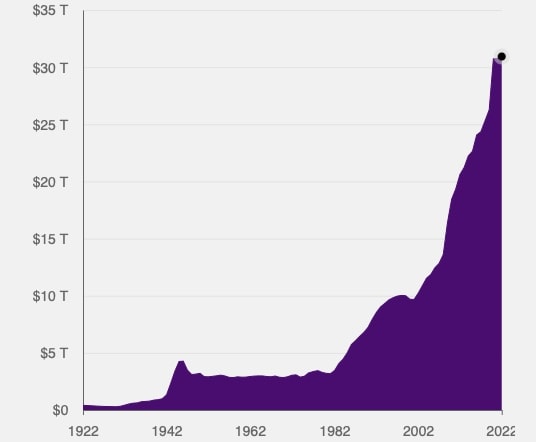

U.S. National Debt

In a scenario where the US dollar hegemony is waning, the US will continue printing money whether it is with, or without consequence (meaning they will continue to print money even if it starts causing very high inflation).

I say this with certainty, not because I can foresee the future, but because I understand simple math.

The United States has A LOT of debt – in excess of 30 trillion dollars. And this is only public debt, not including private debt, or entitlements.

This debt will never be repaid, and it will continue to grow over time. As it grows, it must be continually refinanced.

The larger the debt grows, the more impossible repayment becomes, and the harder debt servicing becomes (affording the interest payments).

When less people, companies, and countries are actively acquiring and holding US treasuries, bond yields rise (interest rates increase), making debt servicing even more expensive.

Luckily for the United States, they can print as much money as they want, and it costs them nothing. This means that their debts can be ‘repaid’ in freshly printed money.

If a country controls their currency, and wishes to repay their debts, it is functionally impossible for a them to default on their debt (in nominal terms).

The problem is that debt grows exponentially, and as it does, it becomes exponentially harder to afford debt servicing.

As a debt burden grows, more and more of the deficit has to be covered with freshly printed money. Although this becomes problematic eventually, a massive burden of debt can defy gravity for many decades.

Recency Bias

Recency bias is a cognitive bias in which people tend to focus on what has been happening recently, and ignore historical precedent.

Historically, what goes up must come down. Just like physics gravity, economic gravity never fails.

Recently, or for the past 40 years, inflation has been relatively low, and economic conditions have been generally favorable in developed countries.

During the past four decades, countries around the world have been printing money like there’s no tomorrow, and finically engineering the consequences into the future (using debt).

A sovereign debt bubble has been inflating, but for decades it has been quiet and non-problematic (seemingly). Our recency bias makes it seem likely that things will continue on as they have been.

In The Sun Also Rises by Ernest Hemingway, the character Mike Cambell famously said that he went bankrupt “gradually and then suddenly”.

Sovereign nations that have been printing money are in the gradually phase of bankruptcy.

My point here is that the suddenly happens, well, suddenly! I want you to be prepared ahead of time for the suddenly phase.

To be very clear, I’m saying that at some point in the future the United States will have amassed such a burden of debt, that it will be forced to print a ton of money to cover its deficit. This will be highly inflationary, and will eventually lead to the death of the dollar.

The dollar is the strongest and most widely used currency in the world, so if the dollar is going down, it’s likely that all other weaker currencies will be faring worse.

Many analysts agree with my perspective here, but it doesn’t get talked about a lot because it’s pretty doom and gloom, and no one can agree on a timeline. It could be tomorrow, and it could be 50 years from now.

How To Store Your Wealth

In a scenario where the U.S. Dollar is inflating rapidly, here is a list of terrible ways to store your wealth. These are virtually guaranteed to become extremely devalued:

- paper cash

- money in checking, and savings accounts

- Treasury Bonds, Treasury Bills

- Pension Funds (because they hold a lot of bonds)

- Most conservative retirement funds (because they hold lot of bonds).

In a scenario where the U.S. Dollar is hyper-inflating, here is a list of slightly less terrible ways to store your wealth. These are likely to be extremely volatile, and will probably lose a ton of value, but they won’t become worthless:

- Stocks

- Real Estate

- 401k / IRA (with stocks not bonds)

In a scenario where the U.S. Dollar is hyper-inflating, here is a list of good ways to store wealth:

- Food

- Water

- Shelter

- Survival equipment

- Self-defense equipment

- Any physical good that is useful to you

- Any physical good that is useful to others (for trade)

In a scenario where the U.S. Dollar is hyper-inflating, here is a list of investments that have a chance of drastically appreciating in value (in real terms):

- Physical Gold

- Bitcoin

Bitcoin

I believe that anyone who wants to be prepared for an uncertain future should own at least a little bit of bitcoin.

To me, bitcoin isn’t a get rich quick scheme, an investment, or even a savings account. It is primarily an insurance policy.

If you don’t have 100% blind trust for your government, bitcoin is probably for you.

If the above chart of the U.S. National debt looks a bit unsettling, you should consider using bitcoin as your insurance policy as well.

What Is Bitcoin?

Bitcoin is money that lives outside of the current financial system.

To function, bitcoin doesn’t need Visa, or Mastercard, or Wells Fargo, or the Federal Reserve, or ACH, or SWIFT, or Wall Street, or anyone else!

Bitcoin is non-state money and it operates independently. In a scenario where the sovereign debt bubble is popping, and fiat currencies are inflating, people will seek alternative money to store their wealth.

It seems likely that in a scenario like this, bitcoin’s use and adoption will drastically increase… and as use and adoption increases, so does the value of bitcoin.

There are no guarantees in life, only probabilities, and I like stacking the odds in my favor. It is my personal opinion that owning at least a small amount of bitcoin stacks the odds in my favor.

Bitcoin Basics

Here is the very basics of what bitcoin is, and how it operates.

Bitcoin runs on its own payment rails called the Bitcoin Network. It’s a network of decentralized nodes.

A bitcoin node is cheap and easy to operate by anyone who wants to participate in the Bitcoin Network.

The ease and low cost of operating a node enables many thousands of node operators all around the world to use bitcoin.

Being operated by thousands of individuals instead of one controlling entity is what makes bitcoin “decentralized”.

Bitcoin Is Decentralized

It’s no accident that bitcoin is decentralized in the way that it is. The point of the decentralization is that there is no centralized entity that controls bitcoin.

There is no owner, no CEO, and no board of directors. There’s just the Bitcoin Network, and if you want to join, then great. No one can change the rules, or shut it down.

It is a bunch of individuals who have banded together and agreed to play by a specific set of rules (the bitcoin protocol).

A government cannot send a cease and desist letter to bitcoin because there is nowhere to send it.

Someone seeking to destroy the network cannot blow up bitcoin’s server farm and take down the network. The Bitcoin Network has thousands and thousands of servers (nodes) all over the world.

If you destroy, or shut down one node, or even 90% of the nodes, it will have essentially no impact on bitcoin continuing to operate as it always does.

To take a deeper dive down the rabbit hole learning about bitcoin nodes and bitcoin mining, check out What is Bitcoin Mining?

Censorship Resistant and Permissionless

Anyone can use bitcoin. And as long as they’re playing by the rules (using the bitcoin protocol properly) they are free to use the Bitcoin Network however they wish.

This means that anyone can send any amount of value (bitcoin), to anyone they want, whenever they want.

This might not seem that novel at first, but we live in a world of big governments, growing totalitarianism, and increasing censorship.

China already has a social credit score system which helps the Chinese Communist Party (CCP) to censor what, when, and how its citizens purchase goods and services.

Because this censorship system uses money as its implementation, it provides the CCP an extremely effective way to incentivize / disincentive the things it deems favorable /unfavorable.

If a government controls the money, they control the people.

If your government wants to limit your access to beef, fossil fuels, guns, or whatever else they deem socially unacceptable, they can disallow payments to non-approved vendors.

Bitcoin doesn’t care who you are, what you stand for, what your social credit score is, what your trying to buy, or who you are trying to buy from. It’s just a perminsionless network, where you can send money to whomever you would like.

This could prove to be one of the biggest selling points for bitcoin in the future.

Bitcoin Gains Value Over Time

Unlike inflationary fiat currencies, bitcoin gains value over time. Sometimes there are large swings in value in the short term, but if you hold bitcoin for longer time periods, it has always gone up in value.

To learn more about these short term fluctuations in value, check out my article Why Is Bitcoin So Volatile?

I’m more interested in using bitcoin as an insurance policy than as a savings account or investment. However, if my insurance policy happens to serve as an excellent investment, I’m not going to complain about it.

I think that any non-zero bitcoin portfolio allocation is an excellent start. For most people, YOLOing their entire net worth into bitcoin is probably a bad idea.

Everyone’s personal financial goals are different, but anywhere above non-zero is a great place to start.

If you have a 1% portfolio allocation to bitcoin, it will probably be enough to serve you very well in the doom and gloom scenarios where currencies are inflating, and the fiat monetary system is breaking.

Thanks for reading!!

If you’re ready to buy some bitcoin, my favorite place to buy bitcoin is: River

or

Ready to learn even more about bitcoin? Check out my article What Is Bitcoin?